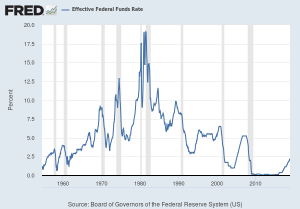

The Federal Reserve is expected to raise the short-term Federal Funds Rate by 0.25% to 2.75% this week. This increase has been telegraphed in advance (as usual) and is therefore typically priced into the market by the time the Fed Rate actually increases.

It is important to note that the Fed doesn’t set mortgage rates. It determines the Federal Funds Rate (the rate at which banks/financial institutions lend money to one another). These higher costs are most directly passed on to consumers in the form of higher interest rates on credit cards, auto loans, etc. (short-term debt). There is of course a correlation with mortgage rates but not as direct as most people think.

With respect to mortgages, this increase in the Fed Rate most directly affects adjustable rate mortgages (because they are short-term) vs. longer-term 15 and 30 year mortgages. It is the 10 year Treasury Note that more directly correlates to these longer term fixed mortgages.

The 10 year Treasury Note currently sits at 2.863%, down from its high of 3.24% on November 8th. This is good news for fixed rate, longer-term mortgages and we’ve seen their rates tick down over the last couple of months.

I am by no means a professional economist, but I did survive more than a couple graduate level Finance courses at Georgetown University. Please feel free to reach out directly for a more robust conversation any time!

Mobile: 805-456-9147

Where we’ve been…